Understanding Paper Trading on TradingView

For aspiring traders looking to enter the financial markets, paper trading offers a safe haven to develop and refine trading strategies without risking real capital. TradingView's paper trading platform stands out as one of the most sophisticated simulation environments available to traders today. This powerful tool replicates real market conditions with remarkable accuracy, allowing traders to experience the market's ebbs and flows while building their confidence.

Paper trading, also known as virtual or simulated trading, serves as a crucial stepping stone between theoretical knowledge and live trading. The platform provides real-time market data, advanced charting tools, and a comprehensive suite of technical indicators that mirror the actual trading environment. This realistic simulation helps traders understand market dynamics, develop disciplined trading habits, and master risk management techniques.

Benefits of Paper Trading on TradingView

The journey to becoming a successful trader requires more than just understanding market theories. TradingView's paper trading platform offers a robust environment where traders can put their strategies to the test while avoiding financial risks. This practice environment proves invaluable for both novice traders learning the basics and experienced traders experimenting with new strategies.

One of the most significant advantages is the ability to trade without the emotional burden of potential monetary losses. This psychological freedom allows traders to focus purely on developing their skills and understanding market behavior. Additionally, traders can simultaneously test multiple strategies across different timeframes and market conditions, providing invaluable insights into various trading approaches.

TradingView also provides comprehensive analytics tools that help traders track their performance, identify strengths and weaknesses, and refine their strategies accordingly. The platform's integration with global markets, including Indian exchanges, ensures traders can practice with the specific instruments they plan to trade in the future.

Setting Up Your TradingView Paper Trading Account

Creating and configuring a paper trading account on TradingView requires careful attention to detail to ensure the most realistic trading experience. The process involves several key steps that help establish a solid foundation for virtual trading practice.

Step 1: Create a TradingView Account

The journey begins with setting up a TradingView account. While the platform offers a free basic account with essential features, serious traders should consider upgrading to a premium subscription. Premium accounts provide access to advanced charting tools, multiple indicators, and enhanced paper trading capabilities that can significantly improve the learning experience.

During the registration process, traders should carefully consider their goals and choose a subscription plan that aligns with their trading aspirations. Premium features such as multiple chart layouts, extended trading hours data, and custom indicators can provide valuable insights that might not be available with a basic account.

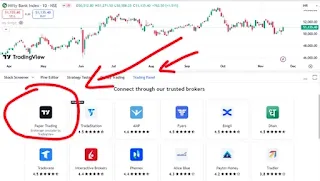

Step 2: Navigate to Paper Trading Mode

After establishing an account, accessing the paper trading environment requires navigating through TradingView's intuitive interface. The platform's layout is designed to mirror real trading platforms, helping traders familiarize themselves with standard trading interfaces.

The paper trading mode provides a realistic simulation of market conditions, complete with real-time data feeds and market depth information. Traders can customize their trading environment by selecting preferred markets, setting up watchlists, and organizing their workspace to match their trading style.

Step 3: Configure Trading Parameters

Proper configuration of trading parameters forms the foundation of effective paper trading. This crucial step involves setting up risk management rules, position sizing guidelines, and default order parameters that align with your trading strategy.

Take time to carefully consider the initial virtual account balance, ensuring it realistically reflects the capital you plan to trade with in the future. This approach helps develop proper position sizing habits and risk management techniques that will prove valuable when transitioning to live trading.

Essential Paper Trading Features on TradingView

The success of any trading simulation heavily depends on the tools and features available to traders. TradingView excels in providing a comprehensive suite of features that create an authentic trading experience, allowing traders to develop their skills in a realistic environment.

Real-Time Market Data

At the heart of TradingView's paper trading platform lies its sophisticated real-time market data system. This robust infrastructure delivers precise, up-to-the-second price information across multiple markets and timeframes. Traders receive the same quality of data they would encounter in live trading, ensuring their practice sessions reflect actual market conditions.

The platform's market depth information provides valuable insights into order flow and liquidity levels. This data helps traders understand how prices move in response to buying and selling pressure, a crucial skill for successful trading. Volume analysis tools complement the price data, offering additional context about market participation and trend strength.

Technical indicators update in real-time, allowing traders to practice making decisions based on dynamic market conditions. The economic calendar integration ensures traders stay informed about important events that might impact their trading decisions, just as they would in live trading.

Order Types Available

TradingView's paper trading platform supports a comprehensive range of order types, enabling traders to practice various execution strategies. Market orders provide immediate execution at the best available price, helping traders understand the concept of slippage and its impact on trading results.

Limit orders allow traders to specify their desired entry and exit prices, teaching patience and the importance of waiting for optimal trading conditions. Stop orders and stop-limit orders provide essential risk management tools, helping traders protect their virtual capital while learning to manage losing positions effectively.

The platform also supports advanced order types like OCO (One-Cancels-Other) and trailing stops. These sophisticated tools help traders automate their exit strategies and manage multiple scenarios simultaneously, developing skills that translate directly to live trading.

Position Management Tools

Effective position management lies at the heart of successful trading. TradingView's paper trading platform offers a comprehensive suite of tools for managing open positions, helping traders develop disciplined trading habits.

Position sizing tools enable traders to calculate appropriate trade sizes based on their account balance and risk tolerance. The platform's risk management features help traders maintain consistent risk levels across different trades, preventing the common mistake of overexposure to single positions.

Stop-loss and take-profit management tools allow traders to plan their exits before entering trades, promoting disciplined decision-making. The ability to scale positions teaches traders how to manage winning trades effectively, maximizing potential profits while maintaining risk control.

Advanced Paper Trading Strategies

Successfully transitioning from basic trading concepts to advanced strategies requires systematic practice and careful analysis. TradingView's paper trading platform provides the perfect environment for developing and testing sophisticated trading approaches.

Strategy Testing

Strategy development forms a critical component of successful trading. TradingView's paper trading environment allows traders to create and test custom indicators that align with their trading methodology. This feature enables traders to validate their ideas before risking real capital.

The platform's backtesting capabilities provide valuable insights into strategy performance across different market conditions. Traders can analyze historical data to understand how their strategies might have performed in the past, helping identify potential strengths and weaknesses.

Performance metrics tracking helps traders understand their strategy's effectiveness across various market conditions. By monitoring key statistics like win rate, average win/loss ratio, and maximum drawdown, traders can make data-driven decisions about strategy improvements.

Risk Management Practice

Developing robust risk management skills represents perhaps the most crucial aspect of trading success. TradingView's paper trading platform allows traders to practice various risk management techniques in a controlled environment.

Position sizing calculations help traders understand the relationship between account size, risk tolerance, and trade size. This knowledge proves invaluable when managing real money, as proper position sizing often determines the difference between success and failure in trading.

The platform enables traders to experiment with different stop-loss placement strategies, teaching the delicate balance between giving trades enough room to breathe and protecting capital. Risk-reward ratio analysis helps traders evaluate whether potential trades align with their overall trading goals.

Best Practices for Paper Trading

Success in paper trading requires more than just technical knowledge. Developing proper habits and maintaining a disciplined approach proves crucial for maximizing the benefits of virtual trading practice.

Setting Realistic Goals

Effective paper trading begins with establishing clear, measurable objectives. Traders should approach each session with specific learning goals in mind, whether focusing on execution timing, strategy refinement, or risk management practices.

Maintaining detailed trading journals helps track progress toward these goals. By documenting trade rationale, execution details, and outcomes, traders can identify patterns in their decision-making process and areas needing improvement.

Regular performance reviews help ensure trading practices align with long-term objectives. This systematic approach to evaluation helps traders identify strengths to build upon and weaknesses to address through focused practice.

Transitioning from Paper to Live Trading

The journey from paper trading to live trading represents a critical phase in every trader's development. While paper trading provides valuable experience, understanding the key differences and preparing for the transition ensures a smoother progression to real-money trading.

Key Considerations

The psychological aspect of trading real money differs significantly from paper trading. Even experienced paper traders must prepare for the emotional challenges that arise when actual capital is at risk. Building a strong foundation through consistent paper trading success helps develop the confidence necessary for live trading.

Creating a comprehensive trading plan before transitioning to live trading proves essential. This plan should detail entry and exit criteria, risk management rules, and position sizing guidelines. Successful paper traders often find that following their established rules becomes more challenging when real money is involved, making a well-documented plan crucial.

Understanding market mechanics becomes increasingly important when preparing for live trading. While paper trading simulates many aspects of the market, certain elements like order flow, liquidity constraints, and transaction costs require additional attention when trading real money.

Performance Evaluation

Systematic evaluation of paper trading results helps determine readiness for live trading. Analyzing key performance metrics provides objective criteria for assessing trading capability. Win rate analysis, while important, should not be the sole criterion for evaluation.

Risk-adjusted returns offer a more comprehensive view of trading performance. This metric considers both profits and the risks taken to achieve them, providing a better indication of strategy effectiveness. Maximum drawdown analysis helps traders understand their risk tolerance and strategy stability.

Calculating metrics like the Sharpe ratio and profit factor helps quantify trading efficiency. These sophisticated measurements provide insights into strategy consistency and risk-adjusted performance, crucial factors for successful live trading.

Advanced TradingView Paper Trading Features

TradingView's platform offers sophisticated tools that enhance the paper trading experience. Understanding and utilizing these advanced features helps traders develop more comprehensive trading skills.

Custom Indicators and Scripts

TradingView's Pine Script language enables traders to create custom indicators tailored to their specific trading strategies. This powerful feature allows for the development and testing of unique trading ideas that go beyond standard technical indicators.

The platform supports the implementation of trading algorithms, enabling traders to practice automated trading strategies. While paper trading automated systems, traders can identify potential issues and optimize their algorithms before deploying them with real money.

Alert systems help traders monitor multiple markets simultaneously, a crucial skill for managing diverse trading strategies. These alerts can be customized to identify specific market conditions or technical setups, improving trading efficiency.

Social Trading Integration

The TradingView community provides valuable learning opportunities through its social trading features. Traders can follow successful traders, analyze their strategies, and learn from their experiences. This social aspect adds a collaborative dimension to the learning process.

Trading ideas shared within the community offer fresh perspectives and potential strategy improvements. Engaging in discussions with other traders helps develop a broader understanding of market dynamics and different trading approaches.

Educational resources available through the platform complement practical trading experience. From basic tutorials to advanced strategy discussions, these resources help traders continue their development while practicing in the paper trading environment.

Paper Trading Tips for Indian Markets

Trading in Indian markets presents unique characteristics and challenges. Understanding these market-specific elements helps traders prepare for successful trading in Indian exchanges.

Market-Specific Considerations

Indian market trading hours differ from other major global markets, requiring traders to adjust their schedules accordingly. The pre-market and post-market sessions offer additional trading opportunities but require understanding of different liquidity conditions.

Price tick sizes in Indian markets vary by instrument and price range. Paper traders must familiarize themselves with these specifications to develop realistic trading strategies. Market regulations, including circuit breakers and trading halts, impact trading decisions and risk management.

Contract specifications for derivatives trading in Indian markets have unique features. Understanding lot sizes, margin requirements, and expiry cycles helps traders prepare for actual trading conditions. Settlement procedures, including delivery versus settlement rules, require careful consideration when developing trading strategies.

Popular Indian Trading Instruments

The Indian market offers diverse trading opportunities across multiple asset classes. Equity stocks, particularly in the cash segment, provide excellent opportunities for both intraday and positional trading strategies.

Index futures, led by popular contracts like Nifty and Bank Nifty, offer high liquidity and leverage opportunities. Currency pairs, especially USD/INR, provide exposure to international market dynamics while trading within Indian regulatory frameworks.

Commodity futures trading in Indian markets requires understanding of both global and local factors affecting prices. Options contracts offer sophisticated trading opportunities but require thorough understanding of derivatives pricing and risk management.

Troubleshooting Common Issues

Even experienced traders encounter technical challenges while paper trading. Understanding common issues and their solutions helps maintain an uninterrupted trading practice experience.

Technical Problems

Platform connectivity issues can disrupt trading sessions and affect performance tracking. Maintaining a stable internet connection and keeping the TradingView platform updated helps minimize these disruptions. When connectivity problems occur, the platform automatically synchronizes data once the connection resumes, ensuring accurate trading records.

Data feed issues occasionally affect price updates and chart displays. Understanding how to refresh data feeds and verify price information helps maintain accurate trading conditions. TradingView's multiple data source integration provides redundancy, reducing the impact of individual feed disruptions.

Order execution problems might arise due to platform settings or user configuration errors. Regular verification of paper trading account settings and order parameters helps prevent unexpected execution issues. The platform's support documentation provides detailed troubleshooting guides for common order-related problems.

Chart loading delays can occur when working with multiple timeframes or indicators. Optimizing chart settings and managing the number of active indicators helps maintain smooth platform performance. Regular clearing of browser cache and temporary files can also improve chart loading times.

Account Management

Effective paper trading requires proper account maintenance and organization. Regular review and reset of account balance helps maintain realistic trading conditions. Many traders choose to reset their paper trading balance monthly to track performance across different time periods.

Clearing trading history periodically helps maintain focused practice sessions. However, maintaining records of significant trades and learning experiences proves valuable for long-term development. The platform allows export of trading history for external analysis and record-keeping.

Organizing watchlists and layouts improves trading efficiency. Creating separate workspaces for different strategies or market sessions helps maintain a structured approach to practice. Regular updates to trading preferences ensure the paper trading environment remains aligned with evolving trading goals.

Frequently Asked Questions

Understanding common questions about TradingView paper trading helps traders maximize their practice experience. This section addresses key concerns and provides detailed guidance for effective platform usage.

General Questions

Is paper trading on TradingView free? The basic paper trading functionality comes with TradingView's free account tier. However, accessing advanced features, real-time data feeds, and multiple chart layouts requires a premium subscription. The investment in a premium account often proves worthwhile for serious traders seeking comprehensive practice capabilities.

How realistic is TradingView paper trading? TradingView's paper trading closely mirrors real market conditions through accurate price feeds, realistic order execution, and proper implementation of market mechanics. The platform simulates various market scenarios, including gaps, volatility spikes, and liquidity conditions. However, traders should remember that emotional factors and actual transaction costs differ in live trading.

Can paper trading predict real trading success? While paper trading success indicates strategy viability and technical proficiency, it cannot fully replicate the psychological challenges of live trading. Successful paper traders often need time to adjust to the emotional aspects of risking real capital. However, developing solid trading habits through paper trading significantly improves the probability of live trading success.

Technical Questions

How many paper trading accounts can I have? TradingView allows users to maintain multiple paper trading accounts, enabling simultaneous testing of different strategies or trading approaches. This flexibility proves particularly valuable when comparing performance across various methods or market conditions. Each account can have different initial balances and trading parameters.

Does paper trading include transaction costs? Yes, TradingView's paper trading platform can simulate transaction costs, including commissions and slippage. Configuring realistic transaction costs helps develop proper position sizing habits and understanding of trade profitability requirements. Premium accounts offer more detailed cost simulation options.

Conclusion

Paper trading on TradingView represents an invaluable step in every trader's journey. The platform's comprehensive features, realistic market simulation, and robust tools provide an excellent environment for developing trading skills without financial risk. Success in paper trading requires dedication, disciplined practice, and systematic evaluation of results.

For Indian traders specifically, TradingView's paper trading platform offers an ideal way to understand local market dynamics and develop strategies suited to Indian trading conditions. The combination of global platform capabilities with local market access creates powerful learning opportunities.

Remember that paper trading serves as a learning tool rather than an end goal. The skills, habits, and strategies developed through careful practice form the foundation for successful live trading. Approach paper trading with seriousness and dedication, treating each virtual trade as an opportunity for improvement and growth.

0 Comments