SBI Card IPO date price and other details

Another big IPO which we were waiting for hits market this march. All details you need about SBI cards and payment services ltd IPO including IPO date, price range, lot size and other details discussed in this video in our channel share market malayalam. Last part explains a trick to improve chance of getting IPO allotment.

SBI Credit card

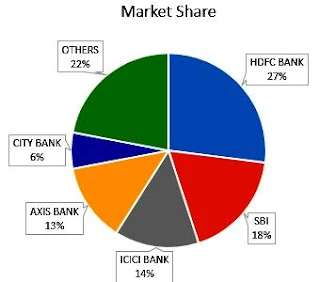

This company was launched in 1988. It was a joint venture between SBI and GE Capital. As name suggests this company deals with credit card business. SBI cards have customer strength of 9 million and stands just below HDFC (as per 2019 data). SBI cards is now owned by SBI and Carlyle group. SBI card will be first credit card company to be listed in India. SBI cards are second largest in India with 18 percent market share in credit cards. They have 17.7 percent share in terms of credit card spending or transaction.

Business Model

SBI card's revenues comes from two things. First is interest income. Second is service fee. Those who use credit cards may know what is credit card interest. Normally credit cards charge very high rate of interest if you fail to repay in time.

Service charge are of 3 types.

- Spend based

- Instance based

- Subscription based

When you transact using credit card in an e commerce website or swipe company will charge a fee. This is spend based fee. Seller wont get full amojnt you pay.. Seller won't get full amount you paid. A small amount will go to credit card issuer, acquirer and payment network.

Acquirer is who provide that swiping machine. Payment network is Visa, Master card or Rupay who monitor these transaction between banks. Issuer is who issued that credit card.

Instance based fees are late fee, cash withdrawal fee, statement retrieval fee etc.

Subscription based fee or annual maintenance charge is a fixed charge charged yearly.

Growth potential of credit card business in India

Government is boosting cashless payment. E commerce business is also growing. These factors also can help to grow this business.

Strong brand presence of SBI is another big factor that attract people to this IPO. SBI's large network and customer base also can help this company in future growth.

Products offered

Cards offered by SBI can be categorised mainly into two. They have SBIs own credit cards and co branded credit cards. SBI own branded cards are simply save, Simpy click, Prime and Elite. Their co branded card are with many other companies also. They currently have tie up with 18+ companies that include IRCTC, FBB, Ithihad guest, Air India, BPCL, Ola money, Yatra etc.

IPO Details

They will be together selling 13.05 cr shares. The will be Offer for sale or OFS by promoters and fresh share issue. SBI will be selling 3.73 and 9.32 crore shares will be offloaded by Carlyle group. Total IPO size is around 9000 crores. There will be fresh issue of 500 crores.Allotment quotas are,

- 35 percent will be allotted to retail investors.

- 15 percent to HNIs.

- 50 percent for QIB.

SBI Card IPO important dates

IPO application date is March 2 to 5. Normally IPOs have 3 day wi dows. But in this IPO there will be 4 days. They are expecting high demand from retail investors for this IPO. So last day will be only for retail investors, HNIs and existing share holders of SBI.Stocks will be credited on 13th March 2020

Will list on NSE and BSE on 16th March 2020

SBI Card basic fundamentals

SBI cards revenue is growing with 44.6 percent CAGR. Here last bar is representing half year.Revenue in 2017 was 3346 cr. In 2018 was 5187 cr. In 2019 revenue was 6999 cr. In current half year it is 4677 cr. It is represented in graph below.

Profit after tax (PAT) is growing at a rate of 51.2 percent CAGR. Here also last bar is representing half year PAT. So you need to consider that while analyzing this graph.

In 2017 profit after tax was 372.8 cr. In 2018 it was 601.1 cr. In 2019 was 862.7 cr. In first half of year 2020 PAT is 725.8 cr.

Business threats and competition

The threats faced by SBI credit card business in future will be from UPI and other private credit card players. Competition in credit card business will increase once more companies come to this business. Also UPI transaction's increasing popularity is also a threat. Another threat in credit card industry is that , loan is provided without any collateral. That risk is always there in this business. But high interest rate will adjust its effect in total number.How to apply for this IPO

To apply for IPO you need a demat account first. You can open a free demat account with upstox or fyers with links given below this post. Then you can use that demat account to apply for SBI card IPO.

Tips to increase chance of getting IPO allotment

SBI share holder quota is 1.31 cr shares. Retails investors can apply in both retail category and share holder quota category. If you hold shares of SBI on 20th February 2020, you are eligible to apply in shareholder category also. To get share in your demat account, you should have bought it 2 days before.Another trick to increase chance of getting IPO allotment is to open demat account for family members and apply from all of them. But keep total lot to less than 2 lakh rupees. You can apply for free demat account in upstox with below link. If adhaar card is linked with mobile, you can open an account within few minutes. You can keep these accounts to apply upcoming IPOs also.

OPEN UPSTOX ACCOUNT

OPEN FYERS ACCOUNT

How to check IPO allotment status

You can check allotment status from this website : Registrar of IPO Link Intime India, the registrar of the IPO. We can search there using our pan card number.

We can also check allotment status in bse website also. This will be better choice I thinks. Previous site is down whenever there is huge traffic on allotment date.

Check video from our youtube channel Share market Malayalam by Muhammad Riyas.

SBI cards IPO - https://youtu.be/Mdexj0GRTLE?si=FoJgYyZDvgvIOAVd

0 Comments