Systematic Investment Plan (SIP) and Systematic Transfer Plan (STP) through Indian Stock Brokers

Introduction

"SIP is a disciplined and systematic approach to investing in mutual funds. It allows investors to contribute a fixed amount at regular intervals (monthly, quarterly, etc.) rather than investing a lump sum amount."

Investing in the stock market can seem overwhelming for many individuals. With various investment options available, it can be challenging to choose the right strategy. One popular approach that has gained traction among investors is Systematic Investment Plans (SIPs) and Systematic Transfer Plans (STPs). In this article, we will explore these investment methods and how Indian stock brokers facilitate them.

Table of Contents

- Understanding SIPs

- Benefits of SIPs

- Step-by-Step Process of Investing in SIPs

- Popular Indian Stock Brokers Offering SIPs

- Evaluating SIP Performance

- Introduction to STPs

- Advantages of STPs

- How STPs Work

- Notable Indian Stock Brokers Offering STPs

- Comparing SIPs and STPs

- Factors to Consider When Choosing SIPs or STPs

- SIP and STP Charges

- Tips for Successful SIP and STP Investing

- Risk Factors Associated with SIPs and STPs

- Conclusion

- FAQs

1. Understanding SIPs

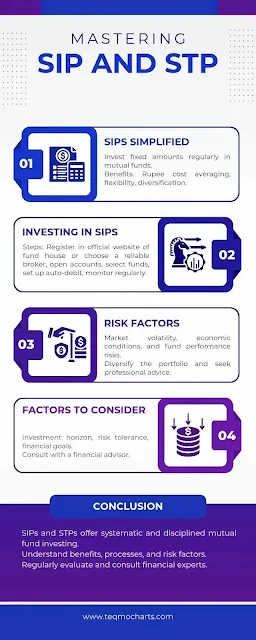

A Systematic Investment Plan (SIP) is an investment strategy that allows individuals to invest a fixed amount regularly in mutual funds. SIPs provide investors with the flexibility to invest small amounts at regular intervals, making it a convenient option for long-term wealth creation. By investing smaller sums of money over time, SIPs empower people across economic backgrounds to reap the benefits of compounding returns and benefit from market ups and downs through rupee-cost averaging.

Whether you are a novice first-time investor or a seasoned market expert seeking a hassle-free approach, SIPs check all the boxes. The foremost advantage lies in the inculcation of investing discipline it promotes. Investing through SIPs necessitates no tracking of market movements or timing strategies. The automatic deductions ensure investing continuity devoid of behavioral biases. This hands-off approach paired with the power of compounding delivers solid long-term wealth creation.

Additionally, several fund houses offer flexibility in SIP investment amounts and frequencies. One can start SIP investment from as low as 500 rupees per month, making it ideal for salaried individuals and students alike. With numerous funds to choose from, SIPs can match diverse investor risk appetites and financial goals including retirement planning, child education, or building an emergency corpus. By starting early and sticking to SIPs, individuals across all walks of life can embark on their wealth creation journey in a stress-free manner.

2. Benefits of SIPs

SIPs offer several advantages to investors:

- Rupee cost averaging: By investing a fixed amount at regular intervals, investors purchase more units when prices are low and fewer units when prices are high, averaging out their investment costs.

- Disciplined investing: SIPs promote regular investing habits and discourage the temptation to time the market.

- Flexibility: Investors can start with a small amount and increase their investment over time as their financial situation improves.

- Diversification: SIPs allow investors to diversify their portfolio by investing in a wide range of mutual funds.

- Liquidity: Investors have the option to redeem their investments partially or completely whenever required.

Rupee Cost Averaging

Cultivating Investing Discipline

Starting Small

Building Diversified Portfolios

Maintaining Liquidity

"SIP employs the concept of rupee cost averaging, which helps mitigate the impact of market volatility. When the market is low, the fixed investment buys more units, and when the market is high, it buys fewer units. Over time, this strategy can result in a lower average cost per unit."

3. Step-by-Step Process of Investing in SIPs

Investing in SIPs through Indian stock brokers involves the following steps:

- Select a reliable and reputable Indian stock broker that offers SIP facilities.

- Open a trading and demat account with the chosen broker.

- Complete the Know Your Customer (KYC) verification process.

- Choose the desired mutual fund scheme(s) based on your investment goals and risk tolerance.

- Determine the SIP amount and frequency (e.g., monthly, quarterly).

- Set up an auto-debit mandate to transfer the SIP amount from your bank account to the mutual fund.

- Monitor and review the performance of the SIP investments regularly.

4. Popular Indian Stock Brokers Offering SIPs

Several Indian stock brokers provide SIP facilities to their clients. Some of the popular ones include:

5. Evaluating SIP Performance

When evaluating the performance of SIP investments, investors should consider various factors such as historical returns, fund manager expertise, expense ratio, and consistency. It is advisable to conduct thorough research and consult financial experts before making investment decisions.

6. Introduction to STPs

A Systematic Transfer Plan (STP) is an investment strategy that allows investors to transfer a fixed amount from one mutual fund scheme to another at regular intervals. STPs are often used to switch investments from debt funds to equity funds or vice versa.

Let's discuss this in detail.

STPs, a strategic approach empowering investors to systematically transfer a predetermined amount from one mutual fund scheme to another at regular intervals. This flexible investment strategy is commonly employed for seamless transitions between debt funds and equity funds or vice versa. STPs offer a methodical way to navigate the dynamic landscape of mutual fund investments, allowing individuals to optimize their portfolio allocation over time. Whether diversifying risk or capitalizing on market opportunities, investors can leverage STPs to align their financial goals with the ever-changing market conditions. Embracing this strategy provides a disciplined and calculated approach to managing investments, enhancing the potential for long-term financial growth. Explore the benefits of Systematic Transfer Plans to make informed choices and navigate the complexities of the mutual fund landscape with confidence.

7. Advantages of STPs

Exploring the advantages of Systematic Transfer Plans (STPs) unveils a range of benefits tailored for investors:

Risk Management: STPs serve as a prudent tool for risk management, enabling investors to navigate market uncertainties by gradually transitioning their investments between diverse mutual fund schemes.

Capital Appreciation: Leveraging STPs strategically empowers investors to tap into potential capital appreciation across various asset classes. This dynamic approach allows them to capitalize on opportunities for growth.

Dynamic Asset Allocation: STPs offer investors the flexibility to dynamically allocate their assets based on prevailing market conditions and individual risk appetites. This adaptability ensures a responsive investment strategy aligned with the evolving financial landscape.

Embracing Systematic Transfer Plans not only provides a structured approach to risk mitigation but also positions investors to capitalize on the dynamic nature of the market, fostering potential for sustained capital growth.

8. How STPs Work

The process of investing through STPs is as follows:

- Choose a mutual fund scheme from which you want to transfer funds (source scheme) and a scheme where you want to invest (target scheme).

- Determine the transfer amount and frequency.

- Set up the STP instruction with your Indian stock broker.

- The specified amount is transferred from the source scheme to the target scheme at predefined intervals.

- Monitor the performance of the target scheme and make adjustments as required.

9. Notable Indian Stock Brokers Offering STPs

There isn't many brokers who have this facility. But you can do this manually.

10. Comparing SIPs and STPs

While SIPs and STPs share some similarities, they differ in terms of their investment strategies and objectives. SIPs focus on regular investments in a single fund, while STPs involve periodic transfers between different funds. Each approach caters to specific investment goals and risk profiles.

11. Factors to Consider When Choosing SIPs or STPs

When selecting between SIPs and STPs, investors should consider factors such as investment horizon, risk tolerance, financial goals, and individual preferences. It is advisable to consult with a financial advisor to determine the most suitable investment strategy.

12. SIP and STP Charges

Indian stock brokers may charge certain fees and expenses for facilitating SIPs and STPs. These charges vary among different brokers and should be taken into account while selecting the investment platform.

13. Tips for Successful SIP and STP Investing

To maximize the benefits of SIPs and STPs, investors should keep the following tips in mind:

- Regularly review and rebalance the mutual fund portfolio to align with financial goals.

- Avoid discontinuing SIPs or STPs during market downturns as it may hinder the potential benefits of rupee cost averaging.

- Stay updated with market trends and news to make informed investment decisions.

- Maintain a long-term perspective and avoid succumbing to short-term market fluctuations.

14. Risk Factors Associated with SIPs and STPs

While SIPs and STPs are considered relatively safer investment strategies, they are still subject to market risks. Investors should be aware of factors such as market volatility, economic conditions, and fund performance risks before investing. It is essential to diversify the portfolio and seek professional advice to mitigate potential risks.

15. Conclusion

SIPs and STPs through Indian stock brokers offer individuals a systematic and disciplined approach to investing in mutual funds. By understanding the benefits, processes, and factors to consider, investors can make informed decisions aligned with their financial goals. However, it is crucial to evaluate risk factors and monitor the performance of investments regularly. Consulting with financial experts will further enhance investment outcomes.

16. FAQs

Is it necessary to have a demat account to invest in SIPs and STPs?

No, it is not necessary to have a demat account for investing in SIPs (Systematic Investment Plans) and STPs (Systematic Transfer Plans). SIP and STP are facilities provided by mutual fund companies that allow you to invest in mutual funds automatically at regular intervals. No demat account is compulsory.

What should be the ideal investment duration for SIPs and STPs?

For SIPs, an investment duration of atleast 5-7 years is recommended so that your investment gets enough time to grow and you can meet your financial goal. For STPs, you need to give an initial lumpsum investment first which will then be periodically moved into another fund/scheme in a systematic manner. So for STPs also an investment duration of 5 years or more is a good time frame.

Can I change the SIP or STP amount later?

Yes, most mutual funds allow you to change the SIP or STP amount later. You just need to submit a request form with your new instructions to change the amount going forward or you can do it online also.

What happens if I miss an SIP installment?

If you miss an SIP installment, only that particular amount will not get invested. The next investment will happen as scheduled. Most mutual funds allow a few SIP date misses before they discontinue your SIP registration, so contact your mutual fund to clarify.

Are SIPs and STPs suitable for new investors?

Yes, SIPs and STPs are very suitable for new investors as they promote the discipline of regular investments and take away the need to time the market, which is difficult for most new investors. The longer you stay invested, the better the rewards with both SIPs and STPs. But always be aware of risk involved in market related products. Invest only after thoroughly reading scheme documents and understanding risk associated with the fund.

0 Comments