What is after market order or AMO order

Do you want to maximize your trading potential with Zerodha? Understanding AMO (After Market Order) is a key step towards achieving that goal. In this article, we'll dive into the intricacies of AMO and how it can benefit your trading strategy. With AMO, you have the power to place orders outside regular market hours. This means you can take advantage of market-moving news or events that occur after the market has closed. Whether you're a busy professional or simply prefer to trade at your own pace, AMO gives you flexibility and convenience. But how does AMO work? We'll explain the process of placing an AMO order and how it differs from regular market orders. You'll learn about the limitations and risks associated with AMO, as well as the best practices to ensure your orders are executed effectively. Stay tuned for expert tips and insights that will help you make the most of AMO in Zerodha. Gain a competitive edge in the market and unlock new trading opportunities with this powerful tool. Let's unravel the world of AMO together.

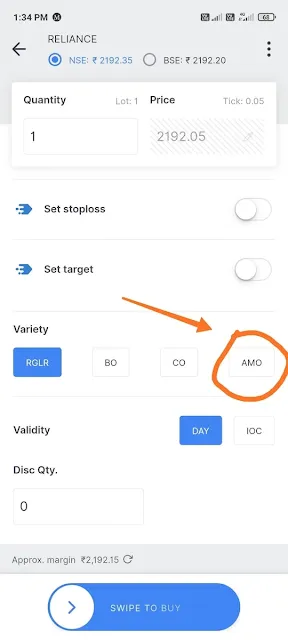

After market orders (AMOs) allow traders and investors to place buy or sell orders for stocks after regular market trading hours. It is an advanced order which helps traders or investors to place buy or sell orders after regular market hour. All other things related to order placing is same. The only difference is you are placing it after regular market hour. Zerodha sends these AMO orders to exchange, next day on market opening. This facility is very helpful for those who can't track market in regular market hours between 9.15 AM to 3.30 PM.

How does AMO order work?

Key Features of AMO or After Market Orders:

- Orders can be scheduled from Monday to Friday in off market hours.

- All order parameters like stock selection, order type, quantity, price etc. remain the same as regular trading hours

- Orders sent to exchange platform next day at market open by broker

- Useful for investors/traders unable to access market 9:15AM - 3:30PM

How to place an AMO order in Zerodha - step by step guide

AMO order in zerodha timing

Advantages of AMO orders

The AMO or After Market Order facility offers some useful benefits that Indian share traders can utilize to their advantage. The key advantage is the flexibility it provides to place orders outside regular market hours. So if a trader missed placing order during the day due to some reason, AMO allows the trader to still put the order after close with price locks.

Another advantage is that AMO acts as a queuing mechanism for orders. So if you want to buy a stock first thing in the morning, you can place the AMO order at night which sits in queue and gets executed right after market open. This increases the chances of order execution at desired price levels compared to placing order next morning. Traders also save time as they don't have to wait next day for market to open to punch order.

AMO can also be strategically used to target specific entry prices for stocks by placing these orders with price limits. For instance, if you want to buy ABC stock around ₹550 which is 1% lower than closing price, you can use AMO to place an automatic order for this price range. If price corrects next day, your order will get filled automatically without manually intervening.

Thus, AMO empowers Indian traders by providing convenience of out of hours order placement coupled with next day auto-execution. Features like queuing priority and price range limits add more strategic dimensions for traders. Prudent use of AMO can improve trade execution efficiency.

Limitations of AMO orders

AMO or After Market Order is no doubt an useful facility offered by Indian brokers, but it comes with some limitations that traders should consider.

First limitation of AMO orders is that you cannot modify or cancel them once the order cut-off time is passed. Suppose you suddenly realize that you made a mistake but the AMO order is already placed and in-queue, you have no option to cancel or edit it. The order will execute next day at market price but you are committed to buying at that price even if it may not suit you.

Another AMO limitation in Indian trading context is that you cannot place these order for all stocks. Low liquid or illiquid securities may not be available for after market order placement. Traders must check with their broker or on order page which specific stocks offer AMO facility.

The most critical AMO limitation remains execution price uncertainty since you cannot predict market movement. So traders who put market order should adopt prudent risk management. While AMO offers convenience of order placement timing, unpredictability of final execution price is a risk Indian traders should acknowledge while using this facility. Checking all broker-specific AMO order restrictions is highly recommended.

Check this video to know more about order types in Malayalam - https://www.youtube.com/watch?v=crU7L6Yvhx8

0 Comments