MIS order in Zerodha

Zerodha Kite has emerged as the most widely used trading platform among Indian retail investors owing to its simple and easy to use interface and robust features. However, for traders starting their investment journey, there may be some confusion around specific order types like MIS orders offered on Kite.

This post aims to simplify MIS orders to help beginners use them effectively while trading stocks, derivatives or commodities on Zerodha. We explain what MIS refers to along with its key benefits compared to other order types.

Most importantly, we discuss ideal scenarios where retail traders can utilize MIS orders to maximize profits and reduce margin required. We also look at another order type CNC order also at last part of this article.

So if terms like MIS, NRML and CNC orders have confused you on Kite in the past, this is the guide for you. Understanding order types is key to optimizing your overall trading experience and enhancing portfolio returns over the long run.

You can read more details about zerodha kite with video here - zerodha kite complete tutorial

What is MIS in zerodha

Margin Intraday Square off or MIS refers to an intraday order type offered on Zerodha's Kite trading platform. It can be used to execute intraday trades across equities, derivatives and commodities segments without needing to allocate upfront margin.

The key benefit of MIS over other order types is the flexibility it offers to utilize your existing trading capital for further trades. If you select MIS order while placing order, you will get intraday margin. This is made possible by the automatic square off of open MIS positions around the market close time if left unclosed by the trader.

In a nutshell, MIS orders allow Indian retail traders to optimize trading capital usage through intraday trades while avoiding overnight risk. Read on to understand more on MIS order mechanics alongside effective utilisation techniques tailored specifically for Indian market dynamics.

How to place MIS order in Zerodha Kite

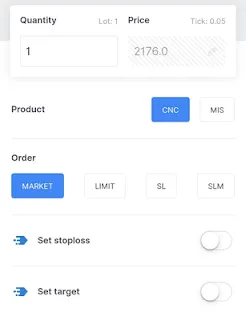

On the Zerodha Kite order entry window, you will find two product types - CNC for delivery trades and MIS for intraday trades.

To place an MIS order specifically for intraday trading:

Step 1) Select the MIS product type from the dropdown list while initiating your buy/sell order.

Step 2) Next, enter the rest of the order details like scrip, quantity, price type and price per unit.

Step 3) Double check order accuracy then click Submit Order to place the MIS intraday trade.

That's it! Following these simple steps allows you to seamlessly place MIS orders on Kite across equity, commodity and currency markets. Do note, at around 3:20 pm any open MIS positions are automatically squared off to mitigate overnight risk.

Uses of MIS order

We will get intraday leverage if we use MIS order. We know we will get leverage for intraday trading. In some stocks you get upto 10 times leverage even after new SEBI margin rules. It varies between stocks. You will also gets leverage for F&O segment and commodity segment. Only in option buying leverage is not provided. To get this leverage in intraday equity, intraday f&o and intraday commodity trading, you should use MIS order.

Another thing is, if we buy a stock for intraday using MIS order it will auto square off at 3.20 PM. This will save us from short delivery, if we short sell a stock intraday and forget to square off. For F&O MIS orders, it will auto square off at 3.25 PM. Zerodha will charge a fee for this auto square off.

If one don't want this leverage, he can use normal CNC order. If he buy with CNC order he don't have to worry about auto square off also because he is holding stocks with fund in his account and not taken any margin from broker. He can square off it same day or can carry forward the position if he wants.

0 Comments