Cover order and bracket order are two commonly used complex order types. They makes a traders life easy by providing option to punch multiple orders in a single order and reducing risk by use of compulsary stoploss.

As a trader, risk management is one of the most important aspect in trading. You should set your risk in a trade before you enter a trade. Some traders set their target also as soon as entering a trade but some like to run profit till a trend reversal. Cover order and bracket order makes this process simple.

Both cover order and bracket order is intraday orders. All bracket order and cover orders will be square off automatically before market closing.

If you want to support us by opening demat and trading account, use any of the links below.

What is cover order and its uses

Using cover order, (commonly known as CO order) you can punch both your buy/sell order and stoploss order in a single order book. Cover order includes a space to enter stoploss along with your buy/sell order.

Once you enter a trade with cover order, system automatically places a stoploss order at a level you mentioned in order. You can find this stoploss order in open orders tab, as soon as you enter a trade.

Eg : If a stock price is Rs. 100 and you want to set a stoploss at Rs.98, you can punch both this orders in one order book as shown in below image.

If you want to exit a position before it hit your stop loss, you can simply cancel your stoploss order from order book. Position will exit. You can also modify your stoploss from order book tab.

What is bracket order and its uses

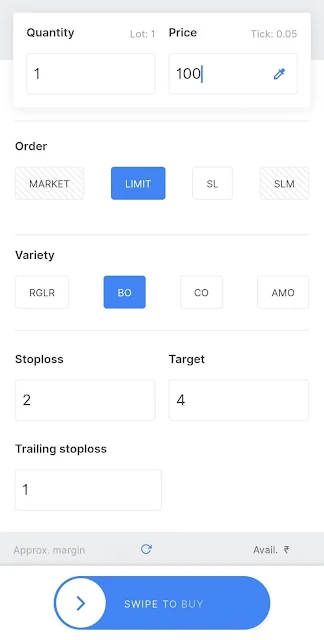

Bracket order is a combination of three orders, You can enter a normal buy/sell order along with a stoploss order and target order. There is an option to enter target also in bracket order along with stoploss and buy/sell order. This is the main difference between a cover order and bracket order. When one of the order - stoploss or target is filled, other gets automatically cancelled.

As I said in the beginning, some traders like to set a target based on their risk (stop loss ) and some like to run profit till trend reversal. For them there is an option to enter a trailing stoploss. If we set trailing stoploss, first stoploss will be automatically moved up, once stock moves in our desired direction by a particular point. Trailing stoploss is optional. If you set a trailing stoploss, you can not edit the order from order book. We will look these things in detail with an example.

Another main thing to note in bracket order is, your stoploss and target should be in absolute points, not price.

Eg: If you want to buy a stock at limit price of Rs.100 and want to keep stop loss at Rs.98 (2 points) and stop loss at Rs.104 (4 points), punch orders like shown in image below.

As soon as you enter the trade, two other orders are placed - stoploss order and target order. Since we have set a trailing stoploss of 1 point, our stoploss will move up by 1 point when our stock moves up by same point.

Before new SEBI margin rules, brokers were providing higher margin for cover order and bracket order. But now they stopped it. But it is a very useful tool for intraday traders.

If you are a beginner in stock market and want to learn about other order types, check our previous posts below.

What is MIS order This post is about MIS order in Zerodha.

What is CNC order This post is about CNC order in Zerodha.

And this is about after market order or AMO

Hope these will be useful for beginners.

0 Comments